Understanding this statement is crucial for homeowners to track their loan progress and make informed financial decisions. By analyzing your mortgage statement regularly, you can identify any errors or discrepancies and address them promptly. Additionally, this statement serves as a record for tax purposes, especially for mortgage interest statements used for deductions. Overall, knowing what is a mortgage statement and how it works empowers homeowners to manage their finances effectively and navigate the complexities of homeownership confidently.

What is a Mortgage Statement?

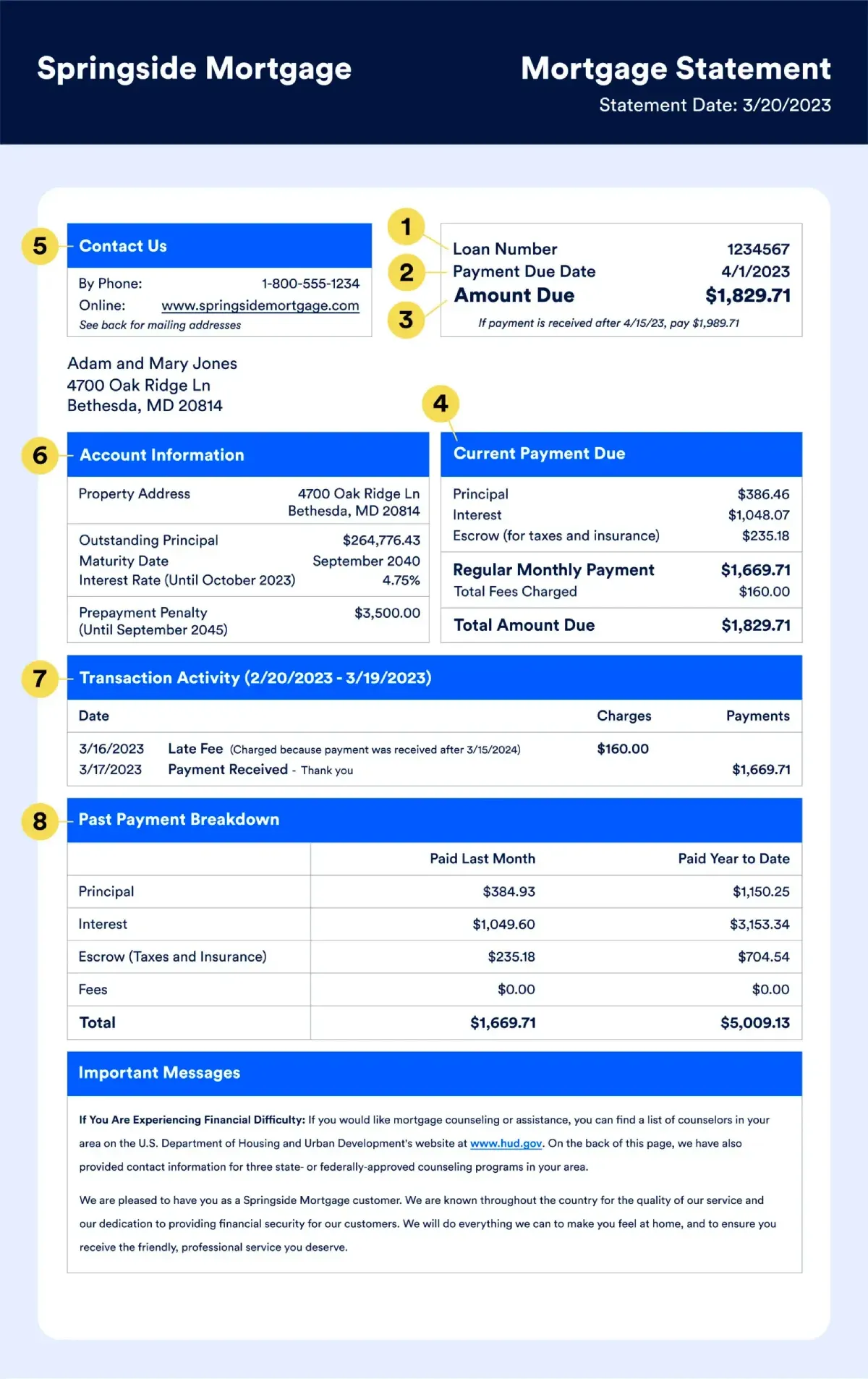

A mortgage statement is a crucial document that summarizes your mortgage loan details. For instance, it includes the remaining loan balance, interest rate, and monthly payment breakdown. Let's consider a mortgage statement example: John receives his monthly statement from his lender. It clearly outlines his outstanding balance, recent transactions, and upcoming payments. By examining this mortgage statement example, John can ensure accuracy in his payments and track his loan progress.

How Do Mortgage Statements Work?

Mortgage statements play a crucial role in the financial management of homeownership. One essential aspect is the mortgage payoff statement, which outlines the remaining balance needed to fully pay off the loan. This statement provides detailed information on how extra payments or adjustments affect the loan's term and overall cost. By understanding how mortgage payoff statements work, homeowners can strategize to pay off their mortgages faster or manage their finances more effectively.

Understanding the Details on a Mortgage Statement

When it comes to comprehending the intricate details on a mortgage statement, a mortgage statement template can be a valuable tool. This template serves as a structured layout that organizes key information such as loan balance, interest rate, payment due dates, and transaction breakdown.

- Loan Information: Includes the loan amount, interest rate, and term.

- Payment Breakdown: Details the monthly payment, portion towards principal, interest, taxes, and insurance.

- Transaction History: Lists all payments made, including dates and amounts.

- Escrow Account: Shows the balance and activity of the escrow account for taxes and insurance.

- Remaining Balance: Indicates the outstanding amount left to pay on the loan.

- Interest Accrual: Explains how interest accrues daily based on the remaining balance.

- Amortization Schedule: Outlines the schedule of payments and how they contribute to principal reduction.

- Contact Information: Provides lender contact details for inquiries or assistance.

- Important Notices: Includes any updates or changes to the loan terms or payments.

Frequently Asked Questions about the Mortgage Statement

Homeowners often have queries regarding their mortgage interest statement (also known as mortgage interest statement 1098). This document summarizes the interest paid on the mortgage throughout the year, crucial for tax purposes. Common questions include how to obtain it, its accuracy, and its role in tax deductions. Understanding the details within this statement aids homeowners in maximizing potential tax benefits. By clarifying doubts surrounding the mortgage interest statement 1098, individuals can ensure compliance with tax regulations and make informed financial decisions regarding their mortgage.

Should I Keep My Mortgage Statements?

Keeping your mortgage tax statement is highly recommended for several reasons. This document provides a comprehensive overview of your mortgage-related expenses, including interest paid, which is crucial for tax purposes. It serves as evidence of your mortgage payments and can help ensure accurate tax filings, potentially resulting in deductions or credits.

Who Provides a Mortgage Statement?

A bank statement mortgage is a type of loan where income is verified through bank statements rather than traditional documentation. In this case, the lender providing the bank statement mortgage is typically the one who also issues the mortgage statement. The statement details key information about the loan, including outstanding balance, interest rate, and payment breakdown. It serves as a crucial document for homeowners to track their mortgage progress and manage their finances.

What is the Difference Between a Mortgage Statement and a Mortgage Note?

While both are essential documents in the mortgage process, they serve different purposes. A mortgage statement provides a snapshot of the loan status, including payment history, outstanding balance, and transaction details. On the other hand, a mortgage note is a legal document outlining the terms and conditions of the loan, including repayment terms and consequences of default. The term "bank statement mortgage loans" refers to a type of mortgage that verifies income using bank statements. Understanding these distinctions is crucial for homeowners to navigate their mortgage obligations effectively.

Can I Get a Monthly Mortgage Statement?

Typically, individuals with a bank statement mortgage loan may not receive a traditional monthly mortgage statement. Instead, these loans often utilize bank statements to verify income and may not follow the conventional mortgage statement format. While the format may differ, lenders providing bank statement mortgage loans may offer alternative methods to access and review loan details regularly.

What is a Mortgage Information Statement?

A mortgage information statement, commonly referred to as Form 1098 mortgage interest statement, is a vital document provided by lenders. It details the amount of interest paid on the mortgage throughout the year. This statement is essential for homeowners for tax purposes, enabling them to deduct mortgage interest from their taxable income. Understanding the intricacies of the Form 1098 mortgage interest statement is crucial for accurate tax reporting and maximizing potential deductions.

What is a Mortgage Year End Statement?

A mortgage year-end statement provides a comprehensive overview of your mortgage account's activity throughout the year. This document includes vital details like total interest paid, additional payments made, and remaining principal balance. Essential for tax purposes and financial planning, it aids homeowners in accurately reporting mortgage-related expenses for deductions and evaluating their repayment progress. It allows borrowers to assess lenders thoroughly, ensuring they choose the best bank statement mortgage lenders who offer transparency, competitive rates, and excellent customer service for their financial needs.

Automatic Mortgage Statement Analysis

Automating mortgage statement analysis streamlines the process of reviewing financial data related to your loan. This includes the 1098 mortgage interest statement, a critical document detailing interest paid over the year. Automated tools can efficiently parse through these statements, highlighting key figures like loan balances, payment schedules, and tax-deductible interest amounts. Embracing automatic mortgage statement analysis, especially when coupled with the 1098 mortgage interest statement, empowers individuals to make informed decisions and manage their mortgages with ease.

Who Prefers Automatic Mortgage Statement Analysis?

Automatic mortgage statement analysis is favored by individuals who prioritize accuracy and efficiency in managing their finances, particularly when it comes to preparing mortgage statements for taxes. This automated approach streamlines the process of reviewing and organizing financial data, ensuring all relevant information is readily available for tax reporting purposes. By automating the analysis of mortgage statements for taxes, individuals can minimize errors, save time, and ensure compliance with tax regulations.